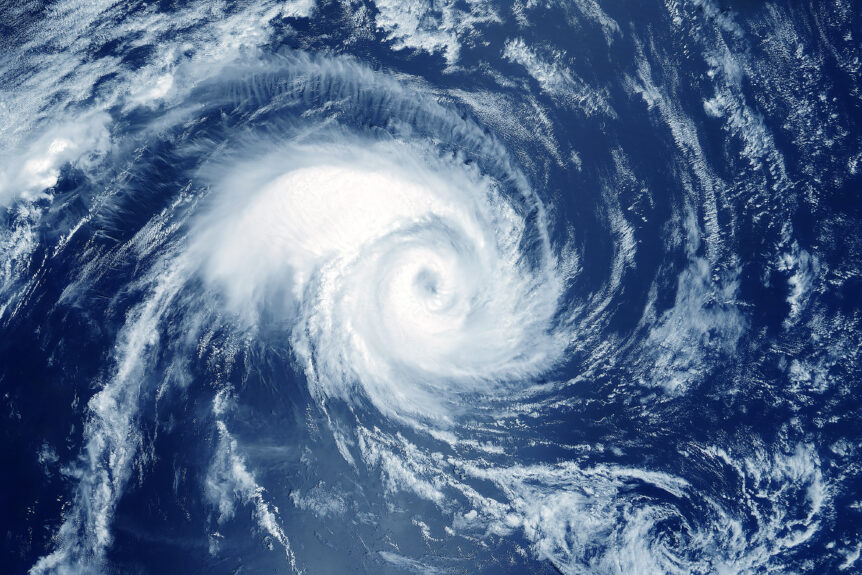

As August quickly rolls in, we are officially entering the peak months of hurricane season. Hurricane season runs from June 1st to November 30th and can be a devastating time of tragedy and loss if you do not adequately prepare.

It’s best to prepare early, as it is common for hurricane season to start off slow and pick up towards the last few months. The busiest month for hurricanes is September, which is when several major storms, including Hurricane Ian, occurred. As you probably remember, Hurricane Ian devastated Florida on September 28th, 2022, leading to at least 160 fatalities and upwards of $50 billion in insured damages.

An average hurricane season consists of 14 named storms, seven of which become hurricanes, including three major hurricanes. We can’t stop hurricanes from coming, but we can be prepared for when they do.

How Much Does Hurricane Damage Cost?

At Deland, Gibson, a common question we receive is, “How much damage can a hurricane do, and what does that cost?” This is a tricky question to answer as it depends on several factors, including the extent of damage, property value, repair costs, etc. However, we can tell you that the annual cost associated with damages from hurricanes continues to increase.

According to a National Oceanic and Atmospheric Administration (NOAA) analysis, “A massive hurricane, a historic drought, and 16 other major disasters across the US collectively racked up $165 billion in damages and killed at least 474 people in 2022.”

Ensuring adequate protection is crucial for consumers in the face of growing concerns about hurricane damage, as well as the interconnected worries about climate change and the rise in sea levels.

How Does a Hurricane Deductible Work?

A typical insurance deductible* is a fixed dollar amount that policyholders agree to pay out of pocket for covered losses before the insurance policy begins to pay. For example, if a claim is filed for $10,000 in damages and the regular deductible is $1,000, the policyholder pays the first $1,000, and the insurance covers the remaining $9,000.

A hurricane deductible is a separate and higher amount that applies specifically to losses caused by hurricanes or tropical storms. It is usually expressed as a percentage of the home’s insured value, typically ranging from 1% to 5%. For instance, if a home is insured for $300,000, and the hurricane deductible is 2%, the policyholder is responsible for the first $6,000 (2% of $300,000) of hurricane-related damages before the insurance policy takes effect. Activating the hurricane deductible depends on specific conditions set by the insurance company, such as the policyholder’s geographical location and state regulations. Homeowners must be aware of their policy’s deductibles, including any hurricane deductibles, to be adequately prepared in the event of such disasters.

*Insurance deductible terminology and terms vary by policy, so it is important to carefully review your policy and consult with your DG representative

Do I Need Flood Insurance?

Flood insurance is a separate policy from homeowners insurance. It provides coverage for both the structure of the home and its contents in the event of flooding from heavy rain, storm surges, and other water-related events that lead to an overflow of water onto normally dry land. While not mandatory for all homeowners, those living in flood-prone areas or with mortgages on properties in high-risk flood zones may be required to purchase flood insurance. However, even if you’re not in a high-risk zone, it’s still worth considering flood insurance, as floods can happen in unexpected areas.

How Can I Prepare for Hurricane Season?

1. Stay tuned

During hurricane season, keeping up with your local weather forecast is crucial. Hurricane watches and warnings are typically announced 48-36 hours before the storm. You can get weather updates on TV, radio, or online.

2. Create a hurricane kit

It is best to have a hurricane kit prepared instead of scrambling to gather supplies once you get a hurricane warning alert. A hurricane kit is a large, easily portable duffle bag filled with emergency supplies you can grab and go, if necessary, upon hearing the news of a hurricane approaching. Even if you intend to ride out the storm from your house, it’s wise to have a hurricane kit prepared.

Your kit should include the following items, at a minimum:

- Drinking water

- Flashlights

- Storm radios

- Canned food that you can eat from the tin

- Manual can opener

- Energy bars

- Crackers

- Prescription medications

- Cash (ideally several hundred dollars)

- Paper towels

- Wet wipes

- Hand sanitizer

- Clothing (two changes of clothing per person)

- Batteries

- Toiletries

- Diapers for babies

3. Make a plan

In the case of a hurricane, it is essential to have a family game plan. You will likely have short notice before the storm, so you must have a plan of action in place. You should be ready to evacuate or stay at home depending on what authorities suggest and where you live.

If you must evacuate:

- Map out an evacuation route based on your city’s emergency plan – plan several routes in case of street closings.

- Make sure your hurricane kit is prepared and easily accessible.

If you must stay at home:

- Stay inside and in a room without windows, skylights, or glass doors.

- Listen to a storm radio for updates on the hurricane.

- Keep your hurricane kit close by.

4. Protect your property

Actions that you should take to get your property ready for a storm include:

- Clear your yard to ensure nothing blows around during the storm and remove any damaged trees.

- Seal windows and doors with storm shutters or plywood.

- Make sure your roof is in good condition.

- Store your valuable items and documents in a safe.

- Regularly check your home’s foundation, basement walls, and floors to prevent floodwater from getting in.

5. Review your insurance coverage

Make sure that you are adequately insured before a hurricane comes. Call Deland, Gibson today.

Frequently Asked Questions

Is There Insurance for Hurricanes?

Technically, no, there is no specific hurricane insurance. You should review your insurance policy with an agent to ensure you are adequately covered. Homeowners’ insurance can cover damage caused by hurricane winds, but you will need a separate policy to cover flood damage. Now is the time to prepare for a hurricane if you aren’t already. Contact a Deland, Gibson agent today to make sure you have adequate insurance coverage for hurricane season.

How Does Homeowners’ Insurance Work for Hurricanes?

Again, while there are no hurricane-specific insurance policies, you can protect your home and assets by ensuring you have adequate coverage to protect against storm winds and flood damage.

Learn More About Damage from Hurricanes and Flooding

Are you interested in learning more about what to do next after a hurricane and flooding in your home? You may find our related articles What To Do After A Hurricane and Does Homeowners Insurance Cover Water Damage highly relevant. Both of these in-depth articles will provide further information on what to do after a hurricane has hit and the impacts of water damage in your home.

Providing Peace of Mind Through Proactive Service

Deland, Gibson: A Trusted Choice, Five Star Accredited independent insurance agency. Established in Massachusetts in 1900, Deland, Gibson is a 4th generation family-run insurance agency that has thrived working as a trusted advisor for its client base. We work with individuals and businesses to lower their Total Cost of Risk. We analyze a client’s direct and indirect costs and implement risk reduction plans to address areas of business, hazard, or strategic risk.